Navigating the Transition in Premium Mobility for Long-Term Investors

As the automotive industry undergoes a profound transformation driven by electrification, software innovation, and shifting consumer preferences, BMW Group stands at a pivotal crossroads. This report provides long-term investors with an in-depth view of BMW’s current financial health, strategic direction, and valuation outlook, based on a full-year review of its 2024 performance and forward projections through 2029.

Company Overview and Industry Context

BMW Group is a global leader in premium mobility, managing an iconic portfolio of brands including BMW, MINI, Rolls-Royce, and BMW Motorrad. In 2024, the company delivered 2.45 million vehicles, of which 17.4% were fully electric, generating €142.4 billion in total revenue. While this reflects a -8.4% decline year-over-year, BMW maintains diversified operations across:

- Automotive: Core passenger vehicles

- Motorcycles: Through BMW Motorrad

- Financial Services: Financing 42.6% of new vehicle deliveries via leasing and credit

The broader industry is undergoing a structural reset. Electric drivetrains, connected software, and regulatory pressures are reshaping automaker economics. Margins from traditional internal combustion engine (ICE) vehicles are declining, while the transition to EVs introduces short- to medium-term cost burdens that may compress profitability before scale is achieved.

Strategic Focus: NEUE KLASSE, Electrification, and Software

BMW’s transformation is anchored in its NEUE KLASSE platform, launching in 2025. This next-generation EV architecture will integrate advanced digital systems, over-the-air updates, and AI-enabled driving experiences. BMW plans over 40 vehicle launches by 2027, expanding its EV and hybrid offerings across segments.

The company’s strategy reflects:

- Flexible drivetrain architecture: Including EV, hybrid, and hydrogen

- Localized global manufacturing: Across Europe, U.S., China, and other key markets

- Sustainability commitment: Targeting 0 g/km fleet emissions by 2035 (EU regulation)

- Circular economy & digital investments: Supporting long-term efficiency

Investors should watch how BMW monetizes these innovations—particularly through software subscription services and potential data-driven fleet solutions.

Financial Performance and Structural Shifts

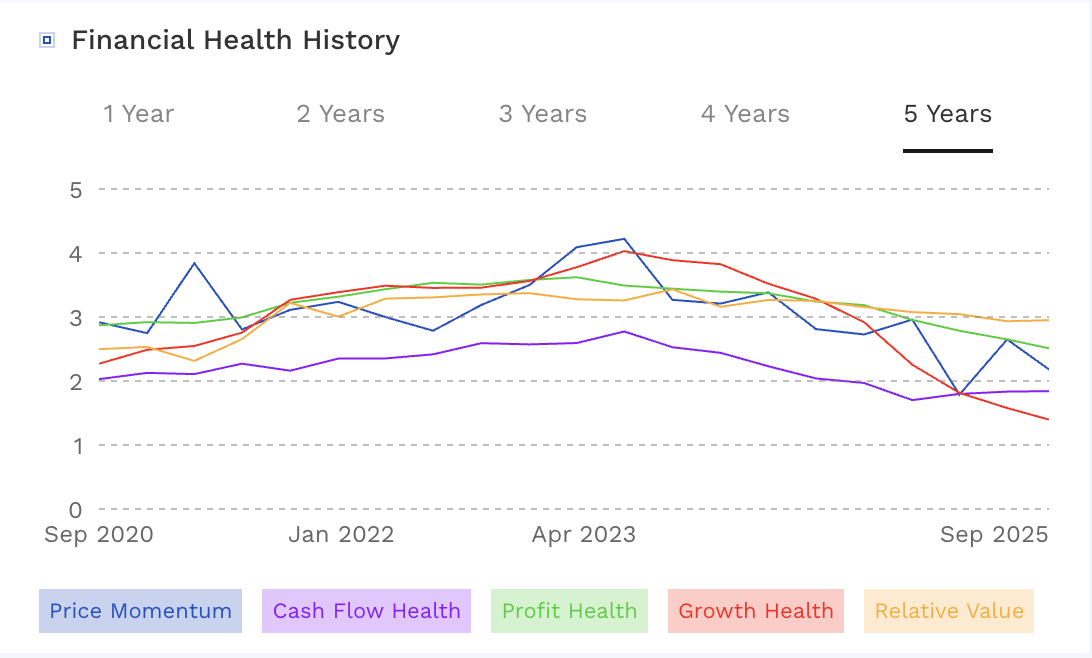

Despite a resilient year in 2024, BMW’s financials reflect the tension between capital reinvestment and revenue plateauing.

Key Metrics (2024):

- Revenue: €142.4B (–8.4% YoY)

- Automotive EBIT: €11.5B (~6.3% margin)

- Free Cash Flow (Auto): €7.8B

- CAPEX: €9.9B (~7% of sales)

While operating performance remained within guided corridors, BMW’s Group earnings before tax (EBT) declined meaningfully, and liquidity cushions played a key role in financial stability.

Forward Outlook (2025–2029):

- Revenue CAGR: ~1.3% annually — flat to slightly positive

- EBITDA Margins: Forecasted to stabilize at 13–14%, down from 22% in 2022

- Working Capital: Expected to rise structurally to 90–94% of sales

- Free Cash Flow: Modest but stable at €6–8B/year

Investor Insight: The company has transitioned from a growth profile to a capital-discipline story. It now trades more like a cash-yield value equity than a high-momentum growth stock.

Valuation Analysis: A Tale of Two Models

BMW’s fair value depends heavily on the lens through which it is viewed.

DCF Valuation:

Our model, assuming a 7.1% WACC and 2% terminal growth, yields a base case equity value of €38.3B. This reflects:

- Lower margin assumptions

- High working capital intensity

- CAPEX pressure without near-term earnings acceleration

Conclusion: The stock appears modestly overvalued at current levels (€50–55B market cap).

Market Multiples Approach:

Applying peer EV/EBITDA multiples to normalized EBITDA of €19.5B implies a valuation range of €83–131B, reflecting:

- Market optimism about NEUE KLASSE execution

- Margin expansion potential

- Strategic flexibility in software and EV monetization

Conclusion: The stock may have significant upside if execution outperforms conservative forecasts.

Fair Value Insight: The current market price reflects a middle ground — investors are not pricing in perfection, but they’re also discounting long-term optionality.

Opportunities vs. Risks: A Balanced Scorecard

Opportunities:

- Expansion of premium EV demand in the U.S., EU, and China

- Growth in BMW M and Rolls-Royce margins

- Stable, recurring income from financial services (~42.6% penetration)

- Potential for software-based revenue streams via in-car tech

- Circular economy efficiencies and regulatory tailwinds

Risks to Monitor:

- Margin pressure from NEUE KLASSE ramp-up and battery input costs

- Slower demand recovery in China (29% of total deliveries)

- Competitive pricing from Tesla, Stellantis, and Chinese NEV makers

- Regulatory compliance (e.g., EU7 standards)

- Execution risk in digital integration and supply chain scaling

Investor Recommendations

| Investor Profile | Action |

| Long-Term Investor | HOLD — Maintain position. Strong brands and EV strategy offer long-term value if execution is successful. |

| New Buyer | WAIT — Price reflects uncertainty; wait for margin/cash flow catalysts. |

| Dividend-Seeker | BUY selectively — Capital preservation + yield play. |

| Short-Term Trader | AVOID — Volatility high, but upside capped without execution proof. |

What to Watch (2025–2026)

- NEUE KLASSE delivery metrics and production cadence

- China market signals — especially luxury vehicle sell-through

- Automotive EBIT margin stability (5–7% corridor)

- Free Cash Flow run-rate above €1B/quarter

- Software monetization via ADAS, subscriptions, or over-the-air features

- Capex and R&D ratios staying below 14% combined

Conclusion: Execution Will Define the Premium EV Story

BMW Group has the brand strength, global infrastructure, and financial discipline to thrive in a world moving toward electric and digital mobility. But its transformation story is complex, and investors must weigh medium-term margin pressure against long-term value creation.

Fair Value News rates BMW a “Hold” with a blended 12-month target of €60B equity value, representing 10–15% potential upside if execution improves.

BMW Valuation Report — Premium Download ($39)

Full 26-page Deep Dive Report — Strategy, risks, and valuation

DCF Model with Graphs & Sensitivity Tables — WACC, EBITDA margin, terminal value

Official 2024 BMW Annual Report (PDF) — So you can see what management said

Editable Excel File — All valuation assumptions, calculations, and peer comps included

(One-time payment. No subscription. Instant access.)